W4 Tax Form 2025

W4 Tax Form 2025 - Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, You may elect an arizona withholding percentage of zero if you. For married couples filing jointly: W4 Tax Form 2025. Using the form correctly can help you avoid owing a large sum of money at tax time or receiving a big refund. But that doesn’t mean you shouldn’t familiarize yourself with it.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, You may elect an arizona withholding percentage of zero if you. For married couples filing jointly:

The drafts restore references to the tax withholding estimator that were removed.

What Is the W4 Form and How Do You Fill It Out? Simple Guide SmartAsset, 2025 michigan income tax withholding tables: Ador 10121 (23) electing a withholding percentage of zero.

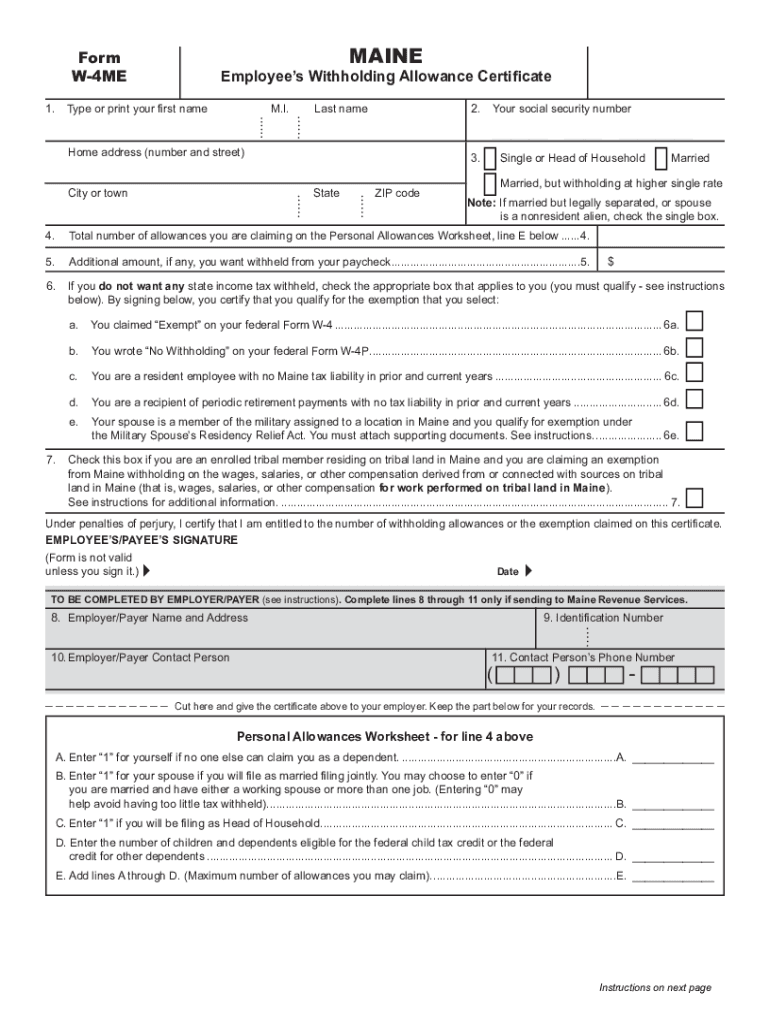

Form used to apply for a refund of the amount of tax withheld on the 2025 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is.

How to Fill out Form W4 in 2025 (2023), The drafts restore references to the tax withholding estimator that were removed. Complete the employee’s tax withholding certificate.

Free Printable W 4 Forms 2025 W4 Form, On the surface, it may seem like the filing status is the easiest part of your income tax form to fill out, aside from your name and address. Ador 10121 (23) electing a withholding percentage of zero.

Request for federal income tax withholding from sick pay.

Changes to W4 2025 W4 Forms, On the surface, it may seem like the filing status is the easiest part of your income tax form to fill out, aside from your name and address. If you are a single tax filer and your combined income is more.

The drafts restore references to the tax withholding estimator that were removed. Federal tax brackets 2025 single.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

Department of the treasury internal revenue service.

W4 Form 2025 Fillable Edie Nettie, Request for federal income tax withholding from sick pay. Form used to apply for a refund of the amount of tax withheld on the 2025 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is.